The Indian 2000-rupee note was introduced in 2016 but has since been phased out. It is no longer in active circulation and has been replaced by other denominations. The decision to demonetize the 2000-rupee note was made to curb corruption and illegal activities. If you have any 2000-rupee notes, you can exchange them at a bank or post office within the specified deadline. Make sure to check the latest guidelines from the Reserve Bank of India for more information.

The Indian 2000-rupee note, introduced in November 2016, has become somewhat of a mystery. People have been left wondering about its current whereabouts as it seemingly vanished from circulation. Where did this high-value currency note disappear to?

The 2000-rupee note was launched as a part of the Indian government’s demonetization efforts to curb black money and counterfeiting. However, it faced various issues regarding counterfeiting and the ease of hoarding large amounts of cash. This led to its gradual withdrawal from circulation, with reports suggesting that its printing has been halted. As a result, the whereabouts of the Indian 2000-rupee note remain uncertain and raise questions about its future role in India’s currency system.

The Evolution of the Indian 2000-Rupee Note

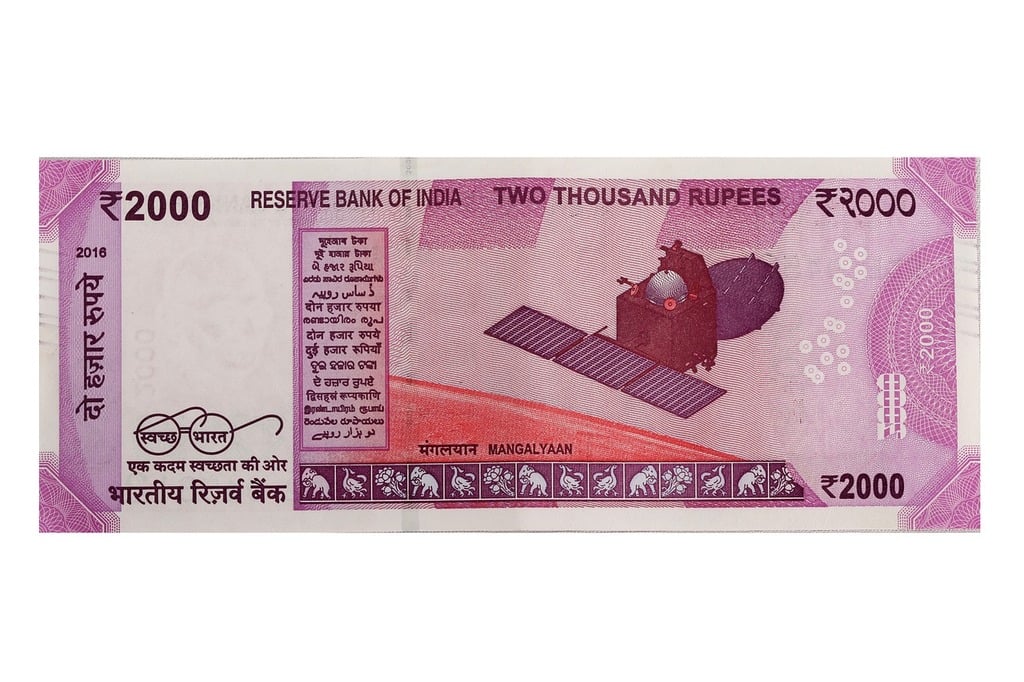

The Indian 2000-rupee note, also known as the INR 2000 note, was first introduced by the Reserve Bank of India (RBI) in November 2016. It was part of a broader currency exchange program aimed at tackling issues of black money, counterfeit currency, and corruption. The demonetization policy involved phasing out the existing INR 1000 and INR 500 notes and replacing them with new ones, including the INR 2000 note.

The INR 2000 note featured advanced security features to counter counterfeiting, such as see-through register, latent image, and color-shifting ink. It was also significantly larger in size compared to the other denominations to aid visually impaired individuals in identifying the currency. However, despite its unique features, the INR 2000 note has faced challenges and controversies.

One of the reasons the INR 2000 note gained attention was its high denomination, as it was the highest-value currency note in circulation at the time. Critics argued that the introduction of such a large-denomination note could facilitate money laundering and corruption. Additionally, the note’s size made it difficult to fit in regular wallets, leading to inconvenience for some individuals. As a result, there have been discussions about the relevance and future of the Indian 2000-rupee note.

However, it’s important to note that the Reserve Bank of India is the authority responsible for determining the circulation and withdrawal of currency notes. As of now, the INR 2000 note remains legal tender, and its status is regulated by the RBI. Understanding the current whereabouts and use of the INR 2000 note requires a closer look at its circulation, acceptance, and potential alternatives.

The Circulation of the INR 2000 Note

The circulation of the INR 2000 note has seen fluctuations over the years since its introduction. Initially, after demonetization, the RBI focused on infusing a significant number of INR 2000 notes into circulation to replace the phased-out denominations. This was aimed at maintaining the liquidity of the economy and ensuring the availability of currency to the public.

However, as time passed, the circulation of the INR 2000 note gradually declined. According to reports, a substantial number of these high-denomination notes were not returning to the banking system, raising concerns about the success of demonetization in achieving its intended goals.

The RBI undertook various measures to address this, such as limiting the printing of INR 2000 notes and focusing on the issuance of lower-denomination currency. These steps were taken to encourage a shift towards digital transactions and reduce the reliance on large cash transactions, which were believed to promote corruption and the shadow economy.

Furthermore, the government’s push towards promoting financial inclusion and the use of digital payment methods, such as mobile wallets and online banking, also contributed to a decrease in the demand for high-denomination currency notes like the INR 2000 note. As a result, its circulation has significantly decreased in recent years.

Acceptance and Usage of the INR 2000 Note

While the circulation of the INR 2000 note has decreased, it is still accepted as legal tender across the country. Most businesses and establishments accept the note, although some may prefer smaller denominations for convenience in making change. The acceptance and usage of the INR 2000 note largely depend on individual transactions and the availability of smaller currency notes.

Individuals often use the INR 2000 note for larger transactions, such as purchasing high-value goods or paying for services. However, due to its higher denomination, it may not be as commonly used in day-to-day transactions for smaller amounts. People usually carry smaller denomination notes like INR 500, INR 200, or INR 100 for everyday expenses.

The INR 2000 note also finds utility in situations where access to banking services or ATMs is limited, such as rural areas or during emergencies. Its higher value allows for carrying a larger amount of money in a single note, reducing the need for multiple lower-denomination notes.

However, it’s worth noting that the acceptance and usage of the INR 2000 note can vary depending on individual preferences, local markets, and the availability of smaller denominations. In some cases, individuals may face challenges in finding establishments that can provide change for larger denomination notes.

Alternatives and Future of the INR 2000 Note

As the circulation of the INR 2000 note decreases and the government promotes digital transactions and financial inclusion, there have been discussions about the need for alternative denominations and the future of the note. Some potential alternatives under consideration include:

- Introduction of a higher-value note: Instead of the INR 2000 note, a new higher-value denomination could be introduced to cater to larger transactions. This could help address concerns about money laundering and corruption while still meeting the needs of the economy.

- Phasing out the INR 2000 note: Another possibility is gradually phasing out the INR 2000 note and replacing it with smaller denomination notes. This could be part of a broader strategy to promote digital transactions and reduce reliance on cash.

- Increased focus on digital payments: The government could further incentivize and promote digital payment methods to reduce the dependence on high-denomination currency notes. This could include providing subsidies, discounts, or benefits for using digital transactions.

The future of the INR 2000 note ultimately depends on the RBI’s assessment of its necessity and the changing dynamics of the economy. As the country moves towards a more digitized and financially inclusive society, the relevance of large-denomination notes may evolve.

It’s important to note that any decision regarding the circulation or withdrawal of currency notes is within the purview of the RBI and the government. The aim is to strike a balance between addressing concerns related to corruption and black money while ensuring the availability of currency for legitimate transactions and day-to-day activities.

Conclusion

As of now, the INR 2000 note remains legal tender and is accepted across the country. Its circulation has seen a decline due to various factors, including the government’s push for digital payments and financial inclusion. The acceptance and usage of the note depend on individual transactions and the availability of smaller denominations.

The future of the INR 2000 note is uncertain, with discussions about potential alternatives and strategies to promote a less cash-dependent economy. Ultimately, the decision rests with the RBI, which will consider the evolving needs and dynamics of the Indian economy.

Frequently Asked Questions

The Indian 2000-rupee note has been a subject of interest and speculation since its introduction in November 2016. With its unique purple color and high denomination, many people have wondered where these notes are now. Here are some commonly asked questions about the whereabouts of the Indian 2000-rupee note:

1. What is the current status of the Indian 2000-rupee note?

The Indian 2000-rupee note is still in circulation and is legally recognized as a valid currency note in India. It is one of the highest denomination notes in the country and is widely used for various transactions.

Since its introduction, the Indian 2000-rupee note has been used for everyday transactions such as purchasing goods and services, paying bills, and conducting business. It is an essential part of the Indian currency system.

2. Where can I find Indian 2000-rupee notes?

Indian 2000-rupee notes can be obtained from various sources. They are available at banks, ATMs, and authorized currency exchange centers. You can also receive these notes as part of your salary or as change when making a purchase.

It is important to note that the availability of Indian 2000-rupee notes may vary depending on the region and the demand for them. While they are widely circulated, it is always advisable to check with your local bank or ATM for their availability.

3. Are Indian 2000-rupee notes being phased out?

As of now, there are no official announcements regarding the phasing out of Indian 2000-rupee notes. They remain a legal tender and will continue to be used in the Indian currency system.

However, it is worth noting that the Reserve Bank of India, the country’s central banking institution, periodically reviews the currency system and may introduce new notes or discontinue existing ones based on various factors such as counterfeiting risks, circulation patterns, and the overall effectiveness of the currency system.

4. Can I exchange Indian 2000-rupee notes for other denominations?

Yes, you can exchange Indian 2000-rupee notes for smaller denominations at banks and authorized currency exchange centers. These facilities provide services for currency conversion, allowing you to convert higher denomination notes into lower ones for ease of transactions.

It is advisable to check the guidelines set by the Reserve Bank of India and the specific policies of the bank or currency exchange center regarding the exchange of Indian 2000-rupee notes before initiating any transactions.

5. Are Indian 2000-rupee notes frequently used in everyday transactions?

The usage of Indian 2000-rupee notes in everyday transactions varies depending on factors such as the purchasing power of individuals, regional practices, and the availability of smaller denomination notes. While the Indian 2000-rupee note is legally accepted, smaller denomination notes like the 500-rupee note are more commonly used for everyday transactions.

However, Indian 2000-rupee notes are still used for high-value transactions, savings, and as a store of value. They provide individuals with the convenience of carrying a higher amount in a smaller number of notes.

The Indian 2000-rupee note is still in circulation but is less commonly seen compared to other denominations.

It was introduced in 2016 as part of demonetization efforts to curb black money, but its usage has gradually decreased over time.

Many people prefer using smaller denomination notes for daily transactions, and the 2000-rupee note is often kept as a savings or investment option.

While it may not be as widely used, the 2000-rupee note is still legal tender and can be exchanged for smaller denominations at banks and authorized outlets.

In conclusion, the 2000-rupee note is still in circulation but is less commonly used for day-to-day transactions.