Imagine reaching retirement only to find out that the nest egg you’ve built isn’t quite enough to maintain your desired lifestyle. Many retirees are pleasantly surprised to find not only financial rewards in part-time work but also a rejuvenated sense of purpose and community. Whether it’s consulting in their field of expertise or exploring new interests, part-time work can be a highly fulfilling and flexible option.

Historically, retirement was viewed as a permanent exit from the workforce, but today it’s often just a transition to a different phase of employment. According to a recent survey, nearly 30% of retirees are re-entering the workforce part-time to supplement their income. This trend isn’t just financially savvy; it allows retirees to stay mentally and socially active, contributing to their overall well-being.

The Rising Trend of Part-time Work in Retirement

In recent years, more retirees have been returning to the workforce for part-time jobs. This shift isn’t just about money. For many, working part-time offers a sense of purpose and community connection.

Statistics show that nearly 30% of retirees are now engaged in part-time work. These jobs allow retirees to supplement their income while staying active. It’s a win-win situation for those looking to balance leisure and productivity.

Employers also benefit from hiring retirees. They bring a wealth of experience and reliability to the table. This makes them valuable assets in various roles, from consulting to customer service.

Retirees are exploring diverse fields for their part-time roles. Some choose to continue in their previous professions, while others opt for something new. Freelancing, tutoring, and retail jobs are popular choices.

Why Retirees Are Choosing Part-time Work

Many retirees find it difficult to stay idle after years of a busy career. They miss the routine and social interaction. Part-time work helps fill this gap and keeps their minds sharp.

Part-time jobs also offer financial stability. Pensions and savings may not always cover unexpected expenses. A part-time job can provide that additional security net.

For some, part-time work relates to their hobbies. Artists, writers, and gardeners often turn their passions into small income streams. This not only gives them joy but also keeps them engaged.

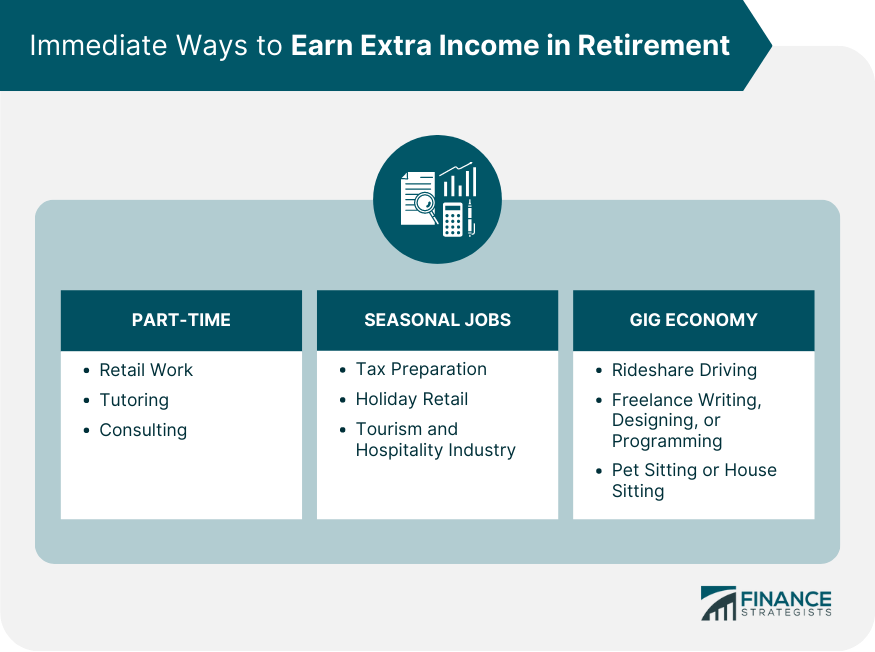

Types of Part-time Jobs Popular Among Retirees

- Consulting: Utilizing years of expertise to advise companies.

- Tutoring: Sharing knowledge with younger generations.

- Retail: Part-time roles in shops and stores.

- Freelancing: Writing, graphic design, and other freelance gigs.

Consulting allows retirees to stay connected to their field without the full-time commitment. Tutoring is a way to give back and share years of knowledge with younger generations. It’s both rewarding and impactful.

Retail positions provide flexible hours and social interaction. They are ideal for those who enjoy customer service roles. Freelancing offers the freedom to work from anywhere, making it popular among digital nomads.

How Part-time Work Impacts Retirement

Part-time employment can significantly enhance a retiree’s life. Financial benefits aside, it keeps them mentally and physically active. This can lead to better overall health and longevity.

Social connections are another benefit. Being around colleagues and customers provides social interaction. This helps combat feelings of loneliness, which can be common in retirement.

Overall, the decision to work part-time after retirement is becoming a popular choice. It offers flexibility, satisfaction, and a steady income. For many, it’s an opportunity to redefine what retirement looks like.

5 GOOD PAYING Paying Remote Jobs For Retirees | Full AND Part Time

Benefits of Working Part-time in Retirement

Working part-time during retirement offers various advantages. It provides a source of extra income, helping to cover unexpected expenses. Additionally, it keeps retirees socially engaged and mentally active.

Many retirees find joy in part-time jobs that align with their interests. This can turn hobbies into income-generating activities. Such roles often bring a renewed sense of purpose and satisfaction.

Financially, part-time work can supplement pension or Social Security benefits. This additional income enhances financial security. It also gives retirees the freedom to spend on travel, hobbies, and family.

For numerous retirees, working part-time offers more than just money. It helps them stay connected to their community. Social interaction and mental stimulation are crucial benefits.

Financial Stability

One significant benefit of part-time work is the financial stability it offers. Retirees can use the extra income to cover medical expenses and other unexpected costs. This helps alleviate the stress of relying solely on savings.

Supplementing retirement income allows retirees to enjoy a higher quality of life. They can afford small luxuries, such as dining out or taking vacations. Financial freedom enhances overall happiness.

Moreover, additional income can be saved or invested. This further secures a retiree’s financial future. Part-time work serves as a safety net in uncertain economic times.

Mental and Physical Health

Part-time work can positively affect mental and physical health. Staying active helps keep cognitive functions sharp. It reduces the risk of age-related mental decline.

Physical activity associated with certain jobs can improve health. Whether it’s standing, walking, or light physical tasks, these activities contribute to fitness. They help maintain mobility and strength.

Work also provides a structured routine. Having regular tasks and responsibilities gives retirees a sense of order. This is beneficial for mental well-being.

Social Interaction

Part-time work keeps retirees socially connected. They interact with colleagues, clients, and customers. This helps combat loneliness, a common issue in retirement.

Social connections can improve emotional health. Positive interactions boost mood and reduce feelings of isolation. Working part-time offers an opportunity to form new friendships.

Being part of a team provides a sense of belonging. This fosters a supportive community. Retirees feel valued and included, enhancing their overall well-being.

Potential Challenges of Part-time Work in Retirement

While working part-time in retirement has numerous benefits, it also presents challenges. Finding suitable part-time positions can be difficult due to age discrimination. Some retirees may feel that their experience is undervalued in today’s job market.

Another challenge is managing the balance between work and leisure. Retirees often struggle to allocate their time effectively. Ensuring enough rest and enjoyment is crucial for their well-being.

Health concerns can also arise. Part-time work might be physically demanding for some retirees. Jobs requiring long hours on their feet or heavy lifting can worsen health issues.

Adaptation to new work environments poses another hurdle. Learning new technologies and procedures can be overwhelming. This adjustment period can be stressful but is necessary for continued employment.

Popular Choices for Part-time Work Among Retirees

Many retirees prefer consulting roles. These positions allow them to use their years of experience. Consulting offers flexible hours and the chance to mentor younger professionals.

Tutoring is another popular option. Retirees enjoy sharing their knowledge with students. It’s a fulfilling job that also supplements their income.

Retail work is a common choice. Many retirees find part-time roles in shops and stores. This work provides social interaction and keeps them active.

Freelancing offers retirees the freedom to work on their own terms. Writing, graphic design, and other freelance gigs are trendy choices. Freelancing can be done from home, which is a significant advantage.

Volunteering is also favored by many retirees. While it may not offer financial benefits, it provides a sense of purpose. Many find deep satisfaction in giving back to the community.

Finally, retirees often take up part-time positions in hospitality. Working in hotels or restaurants can be fun and engaging. It’s a great way to meet new people and stay connected.

Tips for Successfully Integrating Part-time Work into Retirement

First, identify your interests and strengths. Choose a part-time job that aligns with your skills. This makes the work more enjoyable and fulfilling.

Create a flexible schedule. Part-time work should complement your retired lifestyle, not dominate it. Balance is key to enjoying both work and leisure.

Stay open to learning new skills. Many part-time jobs may require you to adapt to new technologies or methods. Embrace this as a chance to grow.

Networking can help you find the right opportunities. Connect with former colleagues, friends, and community groups. Networking opens doors to more job options.

Consider the physical demands of the job. Make sure the role suits your health and energy levels. This ensures you enjoy the work without straining yourself.

Set clear boundaries. Ensure you have time for relaxation and hobbies. This maintains your overall well-being and happiness in retirement.

5 EASY Retirement Side Hustles

Final Thoughts on Part-time Work in Retirement

Part-time work in retirement offers financial benefits and a chance to stay active and engaged. It’s a practical way to enhance your quality of life. Balancing work with leisure ensures a fulfilling retired life.

Choosing the right job that matches your interests and capabilities is crucial. With proper planning and a flexible approach, part-time work can be a rewarding part of retirement. Embrace the opportunities and enjoy this new phase of life.