Imagine a world where your retirement could be significantly more comfortable just by choosing the right investment vehicle. The debate between choosing an IRA or a 401(k) is a common dilemma faced by many experts and professionals alike. Both options offer distinct advantages, but which one stands out as the superior choice for long-term retirement planning?

An IRA, or Individual Retirement Account, has been a staple for individuals seeking flexibility and control over their investments since its inception in 1974. In contrast, the 401(k), introduced in 1978, is primarily offered by employers, often accompanied by lucrative matching contributions. A pivotal statistic reveals that nearly 80% of employers now provide 401(k) plans, underscoring the shifting preference among retirement savers.

IRA vs 401(k): An Overview

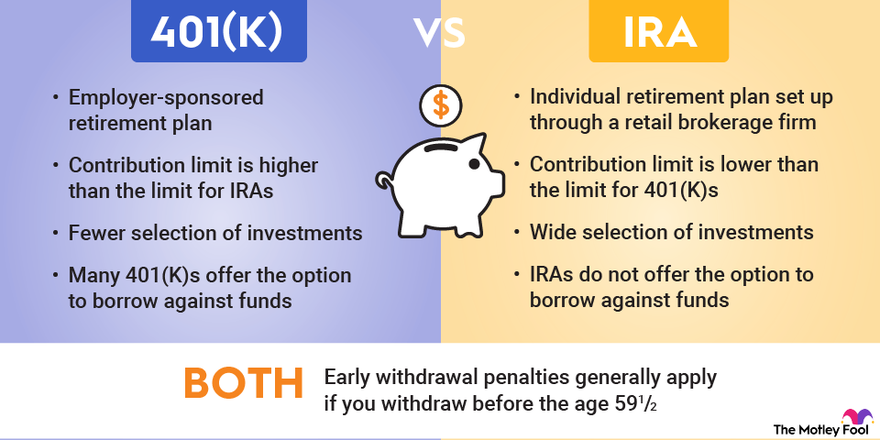

When planning for retirement, two popular options are IRAs and 401(k)s. Both offer tax advantages but function differently. Understanding these differences is crucial for making the best choice.

An IRA, or Individual Retirement Account, is opened by the individual. It offers a variety of investment choices like stocks, bonds, and mutual funds. Contributions to IRAs have limits set by the IRS.

On the other hand, a 401(k) is typically offered by employers. It’s convenient because contributions are automatically deducted from your paycheck. Many employers also provide matching contributions, which can boost your retirement savings.

While both plans aim to help you save for retirement, they have distinct rules and benefits. Choosing between them depends on your specific needs and employment situation.

Tax Advantages of IRAs and 401(k)s

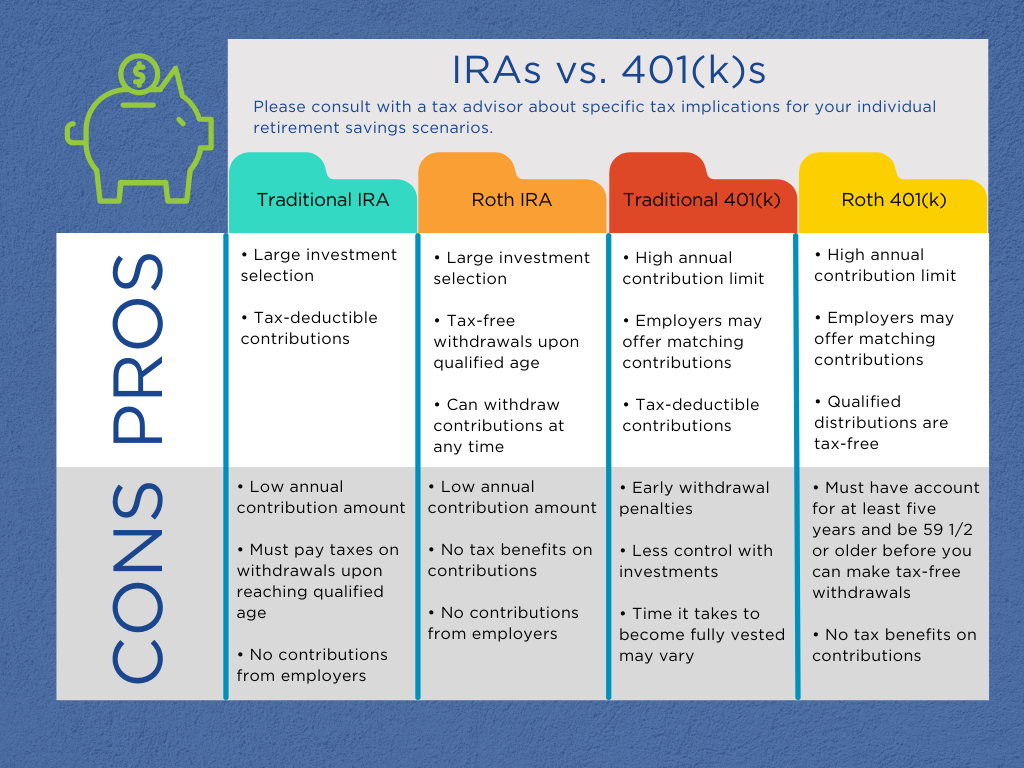

One of the major perks of both IRAs and 401(k)s is the tax advantage they offer. Contributions to a traditional IRA may be tax-deductible, reducing your taxable income. However, Roth IRAs provide tax-free withdrawals during retirement.

401(k) contributions are also made with pre-tax dollars, lowering your taxable income. The growth of investments in both plans is tax-deferred, meaning you won’t pay taxes until you withdraw the money.

Another key point is the tax treatment upon withdrawal. Traditional IRA and 401(k) withdrawals are taxed as ordinary income, while Roth IRAs allow you to withdraw funds tax-free. Understanding these tax implications can help you plan more effectively.

Contribution Limits and Employer Match

Contribution limits vary between IRAs and 401(k)s. For 2023, you can contribute up to $6,500 to an IRA, with an additional $1,000 if you’re over 50. This limit is lower than that of a 401(k).

In contrast, 401(k) accounts have higher contribution limits. For 2023, the limit is $22,500, with an extra $7,500 for those over 50. Additionally, many employers offer matching contributions, which essentially gives you “free” money towards your retirement.

These employer matches are a significant advantage of 401(k)s. It’s like getting a bonus added to your savings, which can substantially increase your retirement fund over time. If your employer offers a match, it’s often wise to contribute enough to get the full match.

Becoming a Millionaire: Roth IRA vs 401K (What makes the MOST PROFIT)

Benefits of Investing in an IRA

Investing in an IRA can be highly beneficial for your retirement savings. It offers several unique advantages that make saving for the future easier. Let’s explore some of these benefits in more detail.

Tax Advantages of IRAs

One of the significant perks of IRAs is their tax benefits. In traditional IRAs, contributions may be tax-deductible, lowering your taxable income. This can provide immediate financial relief and help you save more in the long run.

Roth IRAs, on the other hand, offer a different type of tax advantage. While contributions to a Roth IRA are made with after-tax dollars, the withdrawals during retirement are tax-free. This can be a huge benefit when you retire and need the money the most.

The tax-deferred growth in both traditional and Roth IRAs means your investments can grow without being taxed yearly. This allows your money to compound faster, providing a larger nest egg when you retire.

Flexibility in Investment Choices

IRAs provide a wide range of investment opportunities. You can choose from options such as stocks, bonds, mutual funds, and even real estate. This flexibility allows you to tailor your investment strategy to match your risk tolerance and financial goals.

Having a variety of options means you can diversify your portfolio. A diversified portfolio can reduce risk and increase potential returns over time. This flexibility is not always available in employer-sponsored plans like 401(k)s.

Another advantage is the ability to easily change your investments. Most IRA providers offer straightforward platforms for buying and selling different assets. This makes managing your investments more convenient and responsive to market conditions.

Control and Convenience

With an IRA, you have greater control over your investments. Unlike employer-sponsored plans, IRAs are managed by the individual, giving you the power to make decisions. You choose where and how your money is invested.

This level of control also extends to contributions and withdrawals. While there are contribution limits and rules, you have the freedom to contribute and withdraw within those guidelines. This makes IRAs a highly versatile option for retirement saving.

IRAs are also easy to set up and maintain. Many financial institutions offer low-cost IRAs, and you can usually open one online in just a few minutes. This convenience makes it simple to get started on your retirement savings journey.

Advantages of a 401(k) for Retirement

One of the primary advantages of a 401(k) is the employer match. Many companies match a percentage of your contributions, which is essentially free money. This can significantly boost your retirement savings over time.

Another benefit is the higher contribution limits. For 2023, you can contribute up to $22,500 to a 401(k), which is much higher than the IRA limit. If you’re over 50, you can contribute an additional $7,500, allowing for even greater savings.

401(k) plans also provide the convenience of automatic payroll deductions. This makes saving for retirement easier, as you don’t have to think about making contributions manually. It’s a “set it and forget it” approach that many find useful.

Lastly, 401(k) plans often include a variety of investment options. You can typically choose from a range of mutual funds, including stock, bond, and money market funds. This variety helps you diversify your portfolio, spreading risk and potentially increasing your returns.

A Comparative Analysis: IRA vs 401(k)

When comparing IRAs and 401(k)s, one major difference lies in contribution limits. 401(k) plans allow for much higher annual contributions. This makes them a strong choice if you want to save larger sums.

Another key difference is the flexibility in investment choices. IRAs often offer a wider range of investment options than 401(k)s. You can choose from individual stocks, bonds, and mutual funds, allowing for greater customization.

Employer contributions are another crucial factor. Many employers offer matching contributions to a 401(k), significantly increasing your savings. IRAs, being individual plans, don’t provide this same benefit.

Tax treatment also varies between the two plans. While both offer tax-deferred growth, Roth IRAs allow for tax-free withdrawals. In contrast, traditional 401(k) withdrawals are taxed as ordinary income.

Another point of comparison is the ease of management. 401(k) plans typically involve automatic payroll deductions, simplifying the savings process. IRAs require you to make contributions manually, offering more control but less convenience.

Lastly, consider the rules for withdrawing funds. Both plans have penalties for early withdrawals, but the specifics differ. Understanding these rules is essential for long-term planning.

Choosing Between IRA and 401(k) for your Retirement

When deciding between an IRA and a 401(k), one key factor is employer contributions. If your employer offers a match, a 401(k) can provide immediate returns. This “free money” significantly boosts your retirement savings.

Another consideration is your annual income. Higher earners may benefit more from a 401(k) due to its higher contribution limits. This allows you to save more substantial amounts for retirement.

Flexibility is also essential. IRAs often allow for a wider range of investment options. This provides more opportunities to diversify your portfolio according to your risk tolerance.

If you prefer convenience, a 401(k) might be the better choice. Automated payroll deductions make saving effortless. You don’t need to worry about manually contributing each month.

Consider the tax implications as well. Roth IRAs offer tax-free withdrawals, which can be beneficial in retirement. However, 401(k) plans provide tax-deferred growth, lowering your taxable income now.

Lastly, think about your long-term goals. Some people find that having both an IRA and a 401(k) is the best strategy. This combination maximizes benefits and provides both flexibility and employer contributions.

Roth IRA vs 401K – How to Retire Faster

Final Thoughts on IRA vs 401(k) for Retirement

Choosing between an IRA and a 401(k) ultimately depends on your unique financial situation and retirement goals. Both options offer valuable benefits, from tax advantages to investment flexibility. Understanding these differences can help you make a more informed decision.

By carefully considering factors like employer contributions, investment options, and tax implications, you can choose the plan that best suits your needs. For many, a combination of both an IRA and a 401(k) is the optimal strategy. This approach maximizes the advantages offered by each.